FBO Fall Fuel Sales Survey Results: A Tale of Two FBOs

/If Charles Dickens were to write this blog post about the results of our FBO Fall Fuel Sales Survey, he may very well have begun the way he so poignantly penned the beginning of A Tale of Two Cities: “It was the best of times, it was the worst of times.”

In this Covid-19 induced time of upheaval, we find an FBO industry trying to climb its way out of a very dark March and April, seeking the proverbial light at the end of the tunnel. While some FBOs have caught a glimpse of sunlight, others are seeing shrouds of fog frosting over the lens.

As the survey results show, we are living in the best of times for some FBOs as well as the worst of times for others. It is truly a “Tale of Two FBOs.”

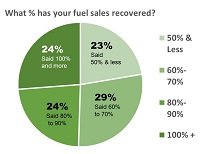

We began our fuel sales survey with this question: Since the start of the Covid-19 Pandemic until now, please indicate the percent your fuel sales have returned/recovered to pre-Covid-19 levels.

As shown in the chart, 23% of respondents indicated that fuel sales are down at least 50% from pre-covid levels.

Conversely, 24% of survey respondents said that fuel sales have returned to at least 100% or more of pre-pandemic levels.

In the middle, nearly one-third of FBOs responding indicated that fuel sales were slowly edging back to between 60% and 80% of pre-covid levels with another 24% reporting a recovery rate of between 80% to 90% in fuel sales.

If we dig deeper into these results, we find that the majority of FBOs reporting near normal fuel sales are located in primary/high population density markets, mainly in the South, as well as destination points throughout the U.S. noted for vacation and second homes. Whereas, the FBOs experiencing lower fuel sales numbers are mainly located in ancillary markets.

In parallel with the slow fuel sales recovery are reports from Argus TracPak data of business aircraft flight activity increasing incrementally month-to-month since a March/April low. The company, which tracks business aircraft flying activity across several categories in the U.S., Canada and the Caribbean, reports that overall flying activity is down nearly 17% year-over-year. Of note, leading up to the beginnings of the Covid-19 pandemic in March, fractional aircraft operations had enjoyed 18 consecutive months of yearly gains in flight activity.

Coinciding with our fuel sales survey, we took part in a recent State-of-the FBO Industry webinar hosted by Business & Commercial Aviation/Acukwik e-newsletter network. As part of the event, a poll was conducted of webinar attendees which mimicked our survey fuel sales question. The results of the poll, which sampled a smaller number of participants, indicated a wider disparity with 44% of respondents experiencing a recovery of only 50% or less of pre-covid fuel sales while just 5% reported fuel sales had returned to 100% or more. To listen to the complete webinar, click here.

Another survey question probed the challenges and concerns facing FBOs: What are the greatest challenges ahead for your FBO and the FBO industry?

The top five concerns included:

- Looking for an end to the Covid-19 pandemic and a return to normalcy

- Keeping employees healthy while on the job

- Ability to retain well-trained employees

- Economic collapse due to pandemic and public fears

- Rising insurance costs and over-regulation

In addition, the following are various quotes from survey respondents reflecting present concerns being faced by their FBO:

“Business has dropped off again after an encouraging July and August. September has not been good. Overcoming the drop-off in fuel sales is our greatest hurdle.”

“Predicting Q4 2020 and what that means to the outlook of 2021. Itinerate operations and fuel have returned to roughly 65%, but concern with the colder months approaching, that will drop significantly.”

“We also depend on the airlines and even though their schedules are returning, many of their flights are “tankering” fuel to our airport, thus our fuel sales to them are way down. Business aviation seems to be very slow in returning. We are definitely seeing increased recreational jet traffic by out-of-state land owners.”

There is no doubt that FBOs are operating in unprecedented times where a global economy can be affected adversely by a surreptitious virus. While we all wait for a Covid-19 vaccine, the FBO Industry could use another round of PPP funding to help bridge the gap. Until then, our industry will reflect a “Tale of Two FBOs.”

Please leave any comments you have about this blog post below. If you have any questions, please give us a call or send us an email: jenticknap@bellsouth.net, 404-867-5518; ronjacksongroup@gmail.com, 972-979-6566.

ABOUT THE BLOGGERS: John Enticknap has more than 35 years of aviation fueling and FBO services industry experience and is an IS-BAH Accredited auditor. Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. Visit the biography page or absggroup.com for more background.

SUBSCRIBE:

Subscribe to the AC-U-KWIK FBO Connection Newsletter

© 2020 ABSG