Results of Our Annual FBO Industry Survey Predict 2.5% Average Fuel Sales Increase for 2015

/

By John L. Enticknap and Ron R. Jackson, Principals of Aviation Business Strategies Group

- Facilitators of NATA’s FBO Success Seminar and Authors of the forthcoming book: FBO Survival: 10 Tips to Keep Your Operations Lean, Mean & Profitable

This week at the NBAA Schedulers and Dispatchers (S&D) Convention in San Jose, CA, we will release the results of our Annual FBO Industry Survey and Forecast for 2015.

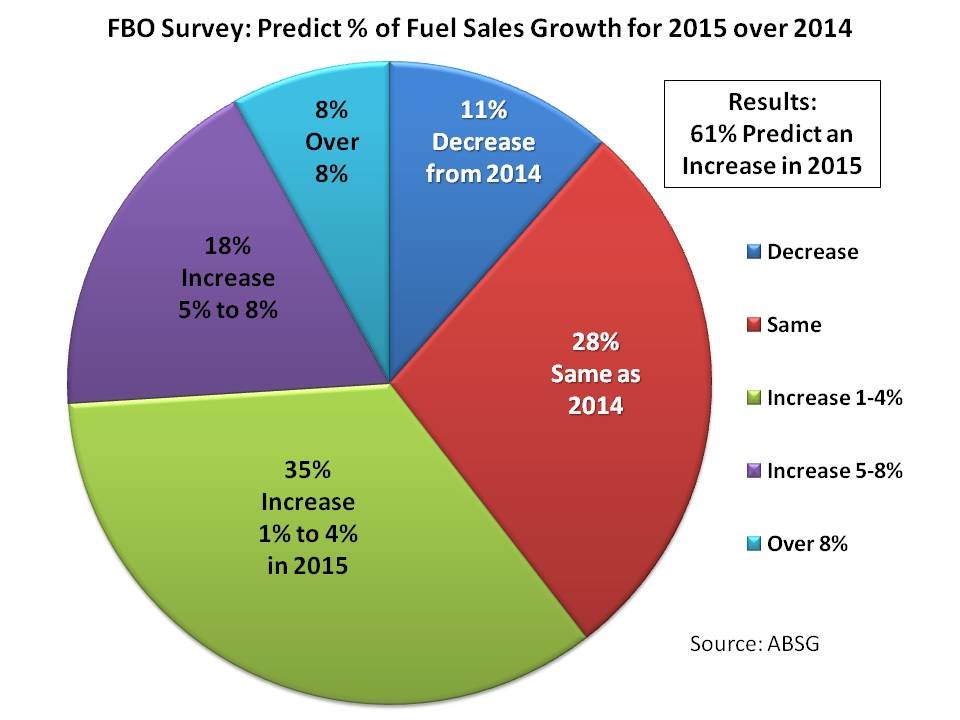

We are happy to report that for the first time in several years, we’re seeing a glimmer of optimism amongst the majority of FBO owners and operators we encounter and are included in the survey. In a nut shell, the results indicate a current market that is yet to catch any real traction but also one that is being approached with guarded optimism with more than 60 percent predicting an average increase in fuel sales of at least 2.5 percent. (See related chart)

This projection follows another year when fuel sales were depressed with the majority reporting an actual decrease in sales in 2014.

Overall, the outlook for 2015 shows a perceptible increase in optimism compared to the results from the 2014 survey where the majority of respondents predicted at least a breakeven marketplace with only about 40 percent projecting an increase in fuel sales volume.

Conversely, in our 2015 survey, more than 60 percent predicted an increase in fuel sales, which represents a positive upswing of 20 percent.

As far as forecasting confidence in the economy, majority of survey respondents moved from having little or no confidence in 2014 to a comfortable middle ground position in 2015. Last year, the majority said the economy was not moving in the right direction. For 2015, most said they are undecided. Again, we see this is an indication of guarded optimism.

In what we call our high-water benchmark, 18 percent of those surveyed this year said they predicted an increase in fuel sales of five to eight percent. This compares to 10 percent responding to the same question in 2014. And for the really strong performers, 8 percent said they expect an increase of more than 8 percent, which is the same result for last year’s survey.

An added question to this year’s survey queried respondents on whether the recent decrease in oil prices has affected the number of aircraft flying into their FBO. An overwhelming majority said the amount of traffic has remained about the same.

What we saw in the comment section of our survey is a general observation that piston aircraft owners, and in particular the weekend enthusiasts, are starting to fly more with lower posted AvGas prices. Also, many who responded indicated that aviation fuel prices will not come down as quickly as auto gas because there is still a lot of higher priced fuel in inventory at airport storage facilities.

In looking at flight hours flown by general aviation and business aircraft, which as we know is a key statistic linked to potential FBO fuel sales, the numbers continued to be flat in 2014. As a result, we really don’t see flight hours increasing in the short term, even though fuel prices are coming down.

Based on our survey findings, we forecast aviation fuel prices continuing to drop throughout 2015 with no appreciable increase in flight activity until the third quarter.

If you are attending the S&D Conference, we would like to see you so please stop by the ACUWKIK Booth #1723. Also, please attend our special Exhibitor Session at 5:15 pm in the Exhibit Hall.

In addition, there will be a drawing at the National Air Transportation Association (NATA) booth #1511 for a free registration for our next NATA FBO Success Seminar scheduled for March 9-10 in Las Vegas. Registrants will receive a free copy of our new book, FBO Survival! 10 Tips to Keep Your Operation Lean, Mean and Profitable. The free registration and book are valued at more than $700.

About the bloggers:

John Enticknap

John Enticknap has more than 35 years of aviation fueling and FBO services industry experience and has served as president/CEO of Mercury Air Centers, a network of FBOs he grew from four facilities to 21 locations. He has international FBO experience including opening the Royal Aviation Terminal in Kuwait. John has held executive management positions with DynAir Fueling and CSX Becket Aviation and holds a Bachelor of Science in industrial management from Northeastern University. He teaches the acclaimed FBO Success Seminar for the National Aviation Transportation Association (NATA) and is an NATA certified safety auditor. John is the co-author of the forthcoming book FBO Survival! Keeping Your Operation Lean, Mean & Profitable. He also writes an industry blog titled FBO Connection for Penton‘s B&CA Digest. He is an active ATP and CFI rated pilot with more than 8,100 flight hours; certified in both fixed and rotary wing aircraft. jenticknap@bellsouth.net, Ph: 404-867-5518, www.absggroup.com

Ron Jackson

Ron Jackson is co-founder of Aviation Business Strategies Group and president of The Jackson Group, a PR agency specializing in FBO marketing and customer service training. He has held management positions with Cessna Aircraft, Fairchild Aircraft and Bozell Advertising. Ron developed the strategic marketing communication plan and programs for Mercury Air Centers and consults with numerous FBOs in areas of marketing, promotions and customer service training. He is the author of Don’t Forget the Cheese! The Ultimate FBO Customer Service Experience. and co-author of the forthcoming book FBO Survival! Keeping Your Operation Lean, Mean & Profitable. He is a journalist and co-developed NATA’s acclaimed FBO Success Seminar Series. Ron writes an industry blog for Penton’s B&CA Digest titled: The FBO Connection. Ron@thejacksongroup.biz, Ph: 972-979-6566, www.absggroup.com